Sustainable Banking & Pensions

Notes from the SOW meeting on 28 Feb 2024. Dates for your diary at the end.

Eight people present; apologies from a large number of people! Jenny and Paul led a discussion on…

Making Change with Money

- Spending – we’re used to thinking about making environmentally conscious choices when shopping

- Saving – if we’re lucky enough to have money to spare, we also need to think about

- Bank accounts (although everyone needs a current account)

- Pensions & investments (such as ISAs)

Two Things to Think About…

(1) Greening our pensions cuts our carbon footprint 21x more than going veggie, giving up flying and switching energy providers combined!

(Research by Make My Money Matter/WWF-UK/Aviva: “Moving the national average pension wealth to the sustainable fund used in the calculation is 21 times more effective (respectively) than the combined annual carbon savings of switching to a renewable electricity provider, substituting all air travel with rail travel and adopting a vegetarian diet.”)

(2) What’s best?

- (Short of avoiding anything to do with the capitalist system – extremely difficult!)

- Divesting from eg fossil fuels and investing in windfarms – eschewing the bad, supporting the good

- Influencing companies through shareholders – by investing you get a say in what “bad” companies do

Banking

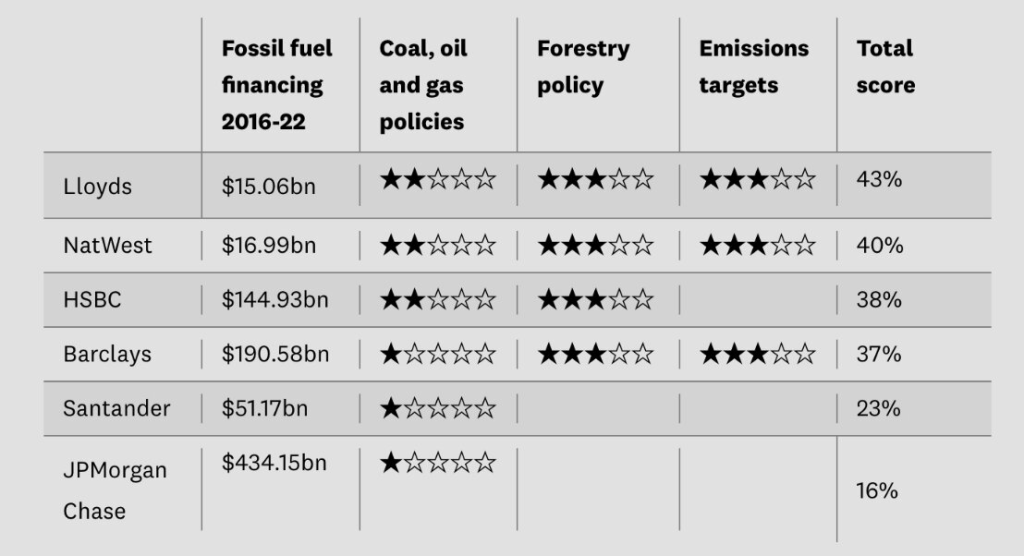

The worst banks include the big household names:

(Source: Which)

High Street banks have been around for hundreds of years, and have been able to get away with unethical practice. Until recently there were no new banks to challenge them – the film “Bank of Dave” describes someone who found a gap in the banking market to help his community! Since then there have been a few other newcomers.

Which? Eco providers for current accounts:

- Nationwide Building Society – only one to have a branch in/near Cambridge. A mutual, investing money in houses via mortgages

- The Co-operative Bank – has long had ethical principles, eco considerations were then added

- Triodos Bank – does not simply exclude eg fossil fuels but seeks out positive causes to lend to

Pensions & Investments

Unscreened investments will use your money to fund whatever makes the most profit. But there are funds which have a small or large degree of ethical screening. (A fund is a collection of investments in different companies which is managed by one fund manager, according to pre-defined criteria.)

“Ethical” considerations are wider than just environmental, eg. avoid alcohol, gambling, arms trade, animal testing. But ideally you’d want to be able to choose what matters to you, eg investing in village-scale artisan alcohol producers OK, investing in BP not OK

“ESG” = Environmental, Social & Governance. You’ll hear this phrase. Many providers now consider ESG risks/performance. (Examples of Environmental: Climate change policies, waste & pollution; of Social: Human rights, labour standards, data protection & privacy; of Governance: Board diversity, Anti-corruption policies, Corporate behaviour.) ESG is positive but does not go very far. Eg. can have tobacco, armaments, and fossil-fuel companies that manage their ESG – publishing annual reports about protecting biodiversity or providing apprenticeships, and some companies “greenwash” – talk about their ESG but don’t actually do much.

“Light green” or “dark green”. Dark green funds are very strongly ethical, avoiding the bad and seeking out positive companies to invest in. Light green funds still have an ethical focus but might not, for example, avoid an oil company altogether, if it was aiming to move over to greener energy. Types of company invested in by most ethical funds also include “neutral” or “helpful” areas of business like medical and food retail.

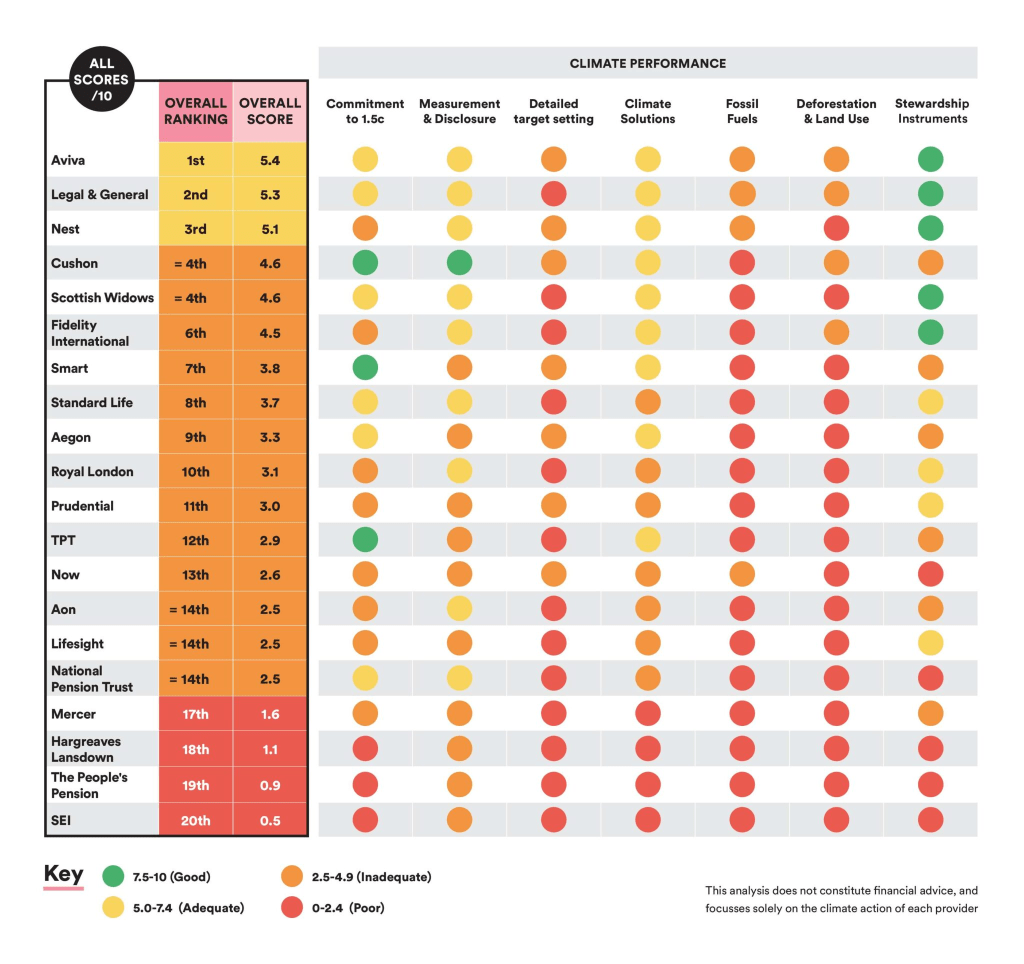

Source: Make My Money Matter. Note that these scores are averaged over all the pension company’s funds. Individual pension funds can be more ethical/sustainable, eg. Aviva will have a sustainable fund.

Performance?

Well-chosen eco funds can perform as well as unscreened. Investing against climate change makes long-term business sense!

Sustainable funds can fluctuate more over the short term. In tougher times the market favours old-school stocks like oil. In times of growth new technologies do better.

What to do?

- May be possible to change funds within pension company. Don’t always have a choice about your workplace pension, but might be possible to change funds within it.

- Or change pension company. This may well cost a fee.

- Specialist IFAs (Independent Financial Advisers). A IFA who specialises in environmental/ethical investment can make sure the new provider both fits your ethics/eco goals and will make also a good return for you. Ethical Consumer has a list and SOW members have personal experience with one of these.

Find Out More

www.ethicalconsumer.org

‘All the information and inspiration you need to revolutionise the way you spend, save and live.’ A consumer organisation a bit like Which? With purchasing advice and a magazine subscription available.

www.makemymoneymatter.co.uk

A movement calling for the trillions of pounds invested in UK pensions to build a better world.

www.which.co.uk/money

The consumer organisation’s Money section, who have information on ethical banks and pension.

Deeper dive into financial skulduggery

As an example, Paul played part of Mark Thomas’s podcast which reveals that all of us until 2015 were effectively paying off the government compensation awarded to slave owners (you read that right, owners, not slaves!) in 1834 when slavery was banned in this country.

Bank of Dave (a film)

Dave in Burnley wants to open a bank, but a new banking licence hasn’t been issued in over 100 years.

Tax Justice Network (website and podcast)

www.taxjustice.net

Taking on a system that fuels inequality, fosters corruption and undermines democracy.

They publish The Financial Secrecy Index and The Corporate Tax Haven Index every two years, which makes for interesting reading, and also produce a very informative podcast.

arbdn Financial Fairness Trust (website and podcast)

www.financialfairness.org.uk

Research, campaigning and policy work to improve life for people on low to middle incomes. Also produce a podcast.

The Dark Money Files (blog and podcast)

thedarkmoneyfiles.com

A blog and podcast with more information than you will ever likely need on money laundering, bribery, corruption, fraud and trafficking.

Treasure Islands (a book)

A book about, amongst other things, how billionaire Warren Buffet, currently the third wealthiest man in the world, paid the lowest rate of tax among his office staff, including his receptionist.

The Spider’s Web: Britain’s Second Empire (a film)

Britain’s transition from colonial power to global financial power

The Things About Us: Slavery (a podcast episode)

Listen to the full podcast, ‘Slavery’ through your podcast provider.

Dates & Notices

- March meeting (27th March) – Leo will re-run the popular fruit tree grafting workshop

- April meeting (24th April) – Alana from Cambridge Carbion Footprint is coming to give a talk about communicating climate change

- May meeting (29th May) – maybe the garden wildlife session, or will people be away because it’s half term?

- Plant swap will be 18th and 19th May

- Eco Club litter pick this Sunday (we think)

- The Repair Cafe on 10 February went well.

- The Green Library was open at the meeting for loans and returns!